On August 8, 2025, the U.S. Attorney's Office for the Southern District of New York, alongside the FBI, announced the unsealing of an indictment against four Ghanaian nationals involved in an elaborate international fraud scheme. This criminal organization exploited online platforms to steal over $100 million from unsuspecting victims, leading to their extradition from Ghana to face charges in the United States. The coordinated efforts of law enforcement from both countries demonstrate the ongoing fight against online fraud, a pervasive threat to individuals and businesses alike.

The indictment against Isaac Oduro Boateng, known as "Kofi Boat," Inusah Ahmed, known as "Pascal," Derrick Van Yeboah, and Patrick Kwame Asare, emerged from a lengthy investigation into a series of romance scams and business email compromise (BEC) schemes that targeted individuals across the United States. Victims largely consisted of vulnerable older adults, many of whom believed they were engaging in genuine online romantic relationships with people who existed only as false identities.

Once trust was established, these scammers would deceive victims into sending money, often under the guise of financial support in relationships that were fabricated. According to the indictment, these fraudulent activities continued to escalate, ultimately resulting in the theft of over $100 million—a sum that represents the financial devastation for many individuals and businesses affected.

Ghana’s cooperation in extraditing three of the defendants on August 7 marked a significant step in this case. However, Patrick Kwame Asare remains at large, a reminder that this criminal syndicate may still operate with a degree of freedom.

Romance scams often begin innocently, with perpetrators creating convincing profiles on social media or dating websites. Through effective manipulation and deceit, they engage victims in digital conversations that can last weeks or even months. Once the scammers build a modicum of emotional closeness and trust, they typically fabricate emergencies or crises that require financial assistance, tricking victims into sending funds.

On the business side, BEC scams work differently but with equally devastating effects. Scammers impersonate high-ranking company officials via email, convincing employees to transfer money under false pretenses. This can include creating false invoices or claiming urgent financial transactions requiring prompt action. By understanding these tactics, individuals and corporations can better protect themselves from such deceptive schemes.

Once the funds were acquired, the organization allegedly laundered the money back to West Africa, instructing lower-tier members—known colloquially as “chairmen”—on how to manage the illicit gains. Both Boateng and Ahmed were identified as key figures within this hierarchy, orchestrating numerous aspects of the criminal operation.

This incident is not isolated; the rise of online fraud and scams has affected thousands globally, especially with the increased use of the internet for social and business interactions. According to the Federal Trade Commission (FTC), romance scams alone cost U.S. victims nearly half a billion dollars in 2021. As online interactions become more common, the potential for scams is perhaps greater than ever.

In comparison to past incidents of mass-scale online fraud, like the infamous “Nigerian Prince” email scam, the techniques have evolved. Modern scammers exploit social networks and digital communication tools with precision, often drawing in victims by appearing credible and trustworthy. The recent indictment underlines a significant crackdown on these organizations, which has become essential as global connectivity increases.

U.S. Attorney Jay Clayton underscored the collaborative efforts between U.S. and Ghanaian authorities in combatting online fraud, emphasizing that “offshore scammers should know that we, the FBI, and our law enforcement partners will work around the world to combat online fraud.” Clayton’s statement reflects a growing consensus among law enforcement agencies that international cooperation is crucial in addressing sophisticated fraud schemes that transcend borders.

Meanwhile, FBI's Assistant Director in Charge, Christopher G. Raia emphasized the need for vigilance against such deceptive practices, stating that “deceiving businesses using email compromise campaigns and tricking innocent elderly victims through fraudulent companionship in order to exploit their trust and finances is not merely appalling but illegal.”

The widespread effects of these scams on victims and communities are profound. Individuals who fall prey to romance scams often face not only financial loss but emotional damage as well. The psychological toll can result in lasting trauma, leading to distrust in future relationships and increased isolation.

For businesses, BEC scams can lead to significant financial losses and harm reputations, potentially jeopardizing entire organizations. As demonstrated in this case, the fallout can propagate across various sectors, highlighting the need for improved cybersecurity measures and employee training.

What Readers Can Do

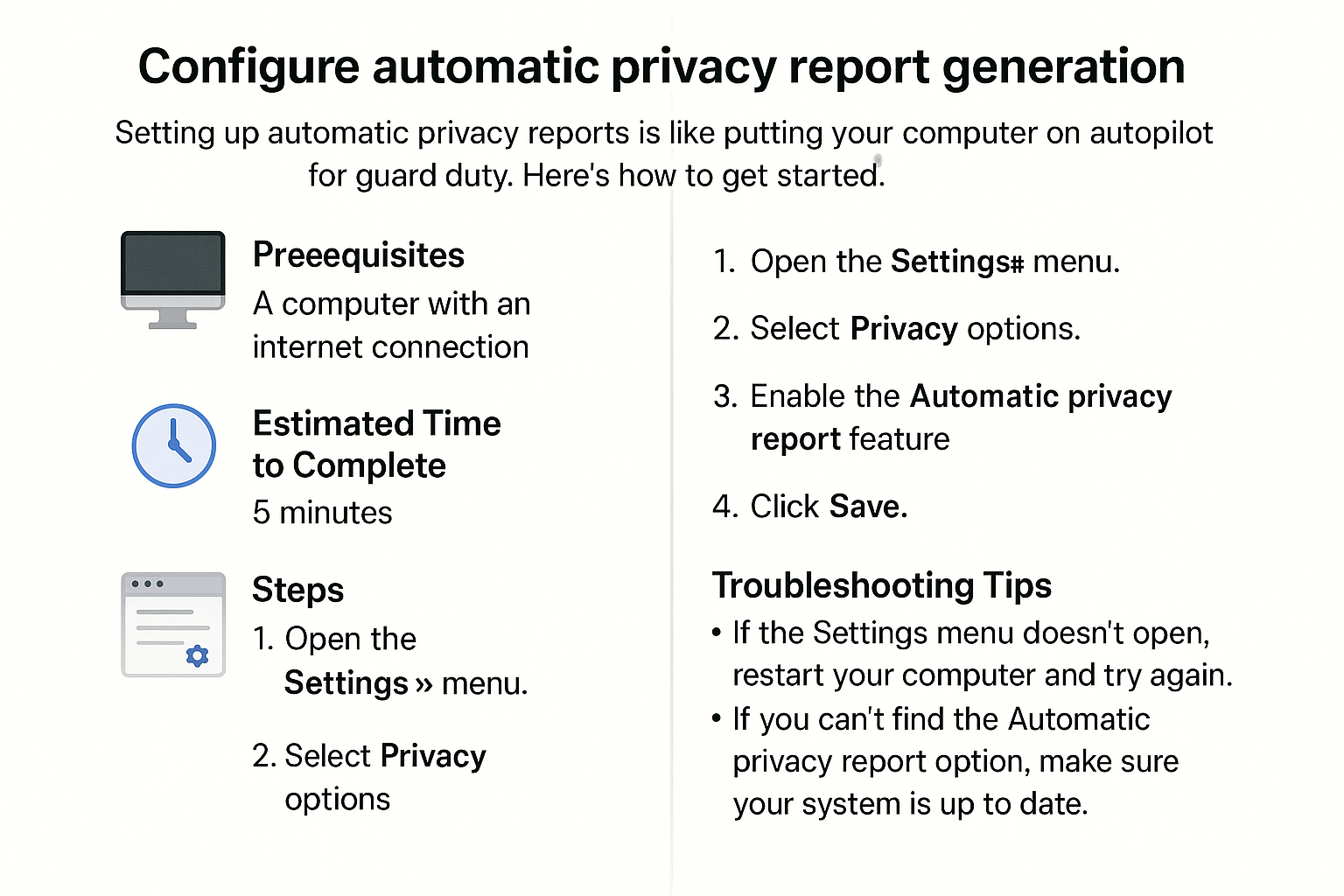

To protect against romance scams and business email compromises, individuals and businesses are urged to take proactive steps:

- Be Skeptical: Always scrutinize online communications, especially those that request money or sensitive information.

- Verify Identities: Do not accept online relationships at face value. Verify identities through secondary means. Video calls can help ascertain authenticity.

- Educate Employees: Businesses should implement training programs to help employees recognize phishing attempts and unauthorized requests.

- Use Multi-Factor Authentication (MFA): Increased security measures can protect email accounts from unauthorized access. This adds an extra layer of protection beyond just passwords.

- Regularly Monitor Financial Accounts: Regular checks can help identify suspicious transactions early, allowing for rapid response.

As the case against these Ghanaian nationals unfolds, it serves as a critical reminder of the ongoing threat posed by online scams. With scammers continually adapting their methods, vigilance remains essential. The proactive measures suggested in this piece can not only safeguard personal and financial information but also contribute to a broader culture of awareness about the risks present in online interactions. The more prepared people are, the less vulnerable they become against these malicious schemes.

References

- U.S. Attorney's Office, Southern District of New York Press Release, August 8, 2025.

- Federal Bureau of Investigation (FBI) Statements.

- Federal Trade Commission (FTC) Reports on Scam Impacts.